HOW TO BUILD A BUSINESS IN ARMENIA? A SUMMARY, A GUIDE, AND RESOURCES.

Get off your ass, and start nation building.

Don’t tell me where your priorities are. Show me where you spend your money and I’ll tell you what they are. —James W. Frick

The sole preservation of Armenia and Artsakh will be through economic development spearheaded by the Diaspora.

The Diaspora has not done enough for Armenia.

Donations are bandages that can’t stop the economic bleeding.

Sending money to family is most effective, but usually only enough to pay for the most immediate needs.

Most Diasporans brew excuses to justify not building a business in Armenia.

To corrupt.

To evil.

To dumb.

To poor.

Most Diasporans find it convenient to donate when they’re being directly acknowledged.

Most Diasporans “speak” or “know” of Armenia through what they read from the internet.. or rather what political party, church, or group they’re apart of.

Full Disclosure: I’ve co-founded and help run two companies in Armenia. It’s remarkable what you can do from your home in the Diaspora…You can make a real impact.

MARKET SUMMARY

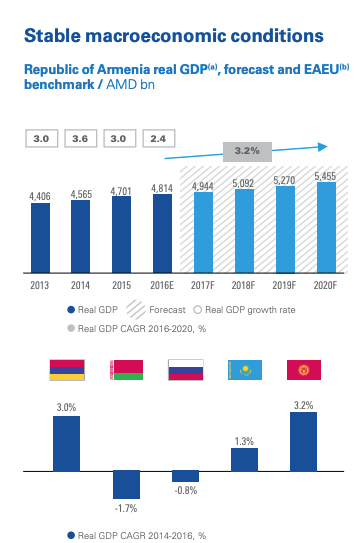

Over the past several years, Armenia has received respectable rankings in international indices that review country business environments and investment climates. A steady macroeconomic environment, low inflation rate, and stable exchange rate provide a predictable and favorable basis for investment.

Clearly written legislation in accordance with international standards and a favorable tax regime create a welcoming environment for foreign investment.

Armenia ranks first among EAEU countries in economic and investment freedom, due to its open legislation to foreign investors, which confirms the country’s commitment to attract and retain foreign investors.

Armenia imposes few restrictions on foreign control and rights to private ownership and establishment.

There are no restrictions on the rights of foreign nationals to acquire, establish, or dispose of business interests in Armenia.

Business registration procedures are straightforward.

Armenia does not limit the conversion and transfer of money or the repatriation of capital and earnings. The banking system in Armenia is sound and well-regulated.

Armenia's Policies Towards Foreign Direct Investment

Armenia has a positive and open attitude toward foreign investment. Reforms in the economy and infrastructure, macroeconomic stabilization, and economic growth have contributed to the development and implementation of the country’s foreign investment policy. The main principles of the investment policy may be summarized as follows:

A liberal attitude towards foreign investments and an Open Door policy

Protection of investors’ rights

Provision of equal conditions for foreign and domestic investors

There are very few restrictions with regard to limitations on foreign ownership or control of commercial enterprises. There are some restrictions on foreign ownership within the media and commercial aviation sectors. Local incorporation is required to obtain a license for the provision of auditing services.

Intellectual Property Rights: Armenia has a strong legislative and regulatory framework to protect intellectual property rights (IPR). Domestic legislation, including the 2006 Law on Copyright and Related Rights, provides for the protection of copyright with respect to literary, scientific, and artistic works (including computer programs and databases), patents and other rights of invention, industrial design, know-how, trade secrets, trademarks, and service marks. The Intellectual Property Agency (IPA) in the Ministry of Economy is responsible for granting patents and overseeing other IPR-related matters.

Money and Banking System: The banking sector is healthy, and indicators of financial soundness, including capital adequacy ratios and non-performing loan rates, have been broadly strong in recent years. The sector is well-capitalized and liquid. Dollarization, historically high for deposits and lending, has been falling in recent years. Non-performing loans have fallen to below 10 percent of total loans. There are 17 commercial banks in Armenia and 14 universal credit organizations. There are no restrictions on foreigners to open bank accounts. Residents and foreign nationals can hold foreign currency accounts and import, export, and exchange foreign currency relatively freely in accordance with the Law on Currency Regulation and Currency Control. Foreign banks may establish a subsidiary, branch, or representative office, and subsidiaries of foreign banks are allowed to provide the same types of services as domestically-owned banks.

The Central Bank of Armenia (CBA) is responsible for the regulation and supervision of the financial sector. The authority and responsibilities of the CBA are established under the Law on Central Bank of Armenia. Numerous other articles of legislation and supporting regulations provide for financial sector oversight and supervision.

Remittance Policies: Armenia imposes no limitations on the conversion and transfer of money or the repatriation of capital and earnings, including branch profits, dividends, interest, royalties, lease payments, private foreign debt, or management or technical service fees.

Labor Policies and Practices: Armenia’s human capital is one of its strongest resources. The labor force is generally well educated, particularly in the science, technology, engineering, and mathematics fields. Almost one hundred percent of Armenia’s population is literate. According to official information, enrollment in secondary school is over 90 percent, and enrollment in senior school (essentially equivalent to American high school) is about 85 percent. Despite this, official statistics indicate a high rate of unemployment, at around 18 percent. Unemployment is particularly pronounced among women and youth, and significant underemployment is also a problem.

Foreign investors can benefit from the following incentives:

100% ownership permitted

Companies registered by a foreigner in Armenia have the right to buy land. Although foreign citizens are not allowed to own land in Armenia, they are offered long-term leases

VAT payment deferral for up to three years for imports of equipment and goods within the scope of investment projects, subject to Government approval

Free exchange of foreign currencies

No restrictions on repatriation of profits

In case of any changes in legislation foreign investors can choose which law to use for up to a five-year term (five-year grandfathering clause)

Free Economic Zones (no value-added tax, no property tax, no profits tax, no customs duties)

Profit tax privileges for large exporters (exported goods and services for at least AMD 40 billion or about USD 84 million.

No export duties and restrictions

No screening and specific authorization required for making an investment

No restrictions on remittances

No restrictions on staff recruitment

No sector-specific or geographic restrictions on investments, except in certain national defense-related sectors

Customs duty exemption on materials and equipment/ technology imported from a non-EAEU country that cannot be replaced by materials and equipment produced by EAEU countries to implement an investment project in priority sectors of the Armenian economy and exceptionally in the territory of Armenia are exempt from customs duties.

Tax exemptions in border areas of Armenia — Tax exemptions in the Tavush region of Armenia (operations within the framework of investment projects over AMD 2 billion or about USD 4.2 million, except those in mining and chemical production sectors)

Armenia enjoys completely automated tax filing and tax payment systems. All taxes can be filled and paid electronically, which considerably facilitates the fulfillment of taxpayer duties and lowers the tax administrative burden for businesses.

VAT has a rate of 20% of taxable turnover.

For non-residents, specific tax rates apply: — 5% on insurance compensation, reinsurance payments, and income received from freight — 10% on dividends, interest, royalties, income from the lease of property, capital gains (will be 0% from 2018) and other passive income (with the exception of income received from freight) — 20% on income from other services provided by nonresidents

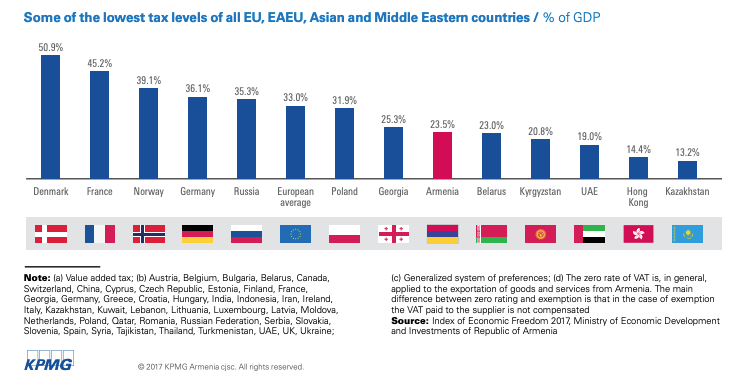

Armenia has some of the lowest tax levels of all EU, EAEU, Asian, and Middle Eastern countries % of GDP

A Guide to Starting a Business in 🇦🇲

It seems like many of us are interested to help jump-start this new Armenia's economy, and it's time to start shifting our focus from charity towards investment and job creation. Let's share ideas on every kind of investment that the Diaspora can help with. Below I present you with multiple opportunities that Armenia has where you can get involved. This includes how to start a business so you can start working today!

Opportunities in Armenia

The financial sector provides a favorable infrastructure for investments in the country. The market is highly-developed: international banking and financial groups are well-presented in the market. The sector-specific legislation is in line with relevant international standards. There were no insolvency cases during the last 15 years what indicates market stability.

Start an investment firm, mortgage bank, or real estate trust, and invest capital from Armenia all over the world.. all from your office in Yerevan or Dilijan. Hire market analysts, developers, researchers, and operations experts directly in Armenia.

The agricultural sector allows the opportunity to market agricultural products with minimal customs fees and bureaucratic trade barriers within the EAEU market of more than 180 million consumers Potential usage of tax incentives supported by the government can facilitate an increase in the profitability of agricultural business Currently announced projects total USD 278 million with opportunity for foreign investment

Fresno Armenian’s with farms.. you can do all your marketing out of Armenia, export directly to the EU, all while lowering your expenses in the US and putting Armenians to work. Or.. use your knowledge and your financial capability to invest, manufacture, and sell farming or agriculture equipment in the US, and within Armenia.

The IT and RD sector is filled with highly qualified technical specialists due to a strong educational heritage, leading to the active and developing partnership of R&D institutions with business. The qualifications of Armenian IT specialists have already been confirmed by global IT companies such as Microsoft, IBM, and Synopsys, who have chosen Armenia as a preferred location for their work A growing sector with increasing export opportunities: 30% CAGR over 2011-2016, and on target to double by 2018 as compared to 2016. Significant government support creates a favorable IT startup environment (0% profit tax, 10% income tax). Opportunities for opening a local R&D/IT development base following the example of several multinational firms already operating in Armenia.

Build a product, website, project all in Armenia with Armenian Developers. Pay them 400% of the minimum wage of Armenia. Increase training and exposure to professional and career development. WATCH OUR COUNTRY SUCCEED.

The renewable energy sector is developing rapidly due to Armenia’s significant natural renewable resources for both local consumptions and exporting to neighboring countries (electricity production in small HPPs grew by around 54% over the last 5 years). The Government provides significant incentives for investing in renewable energy, including guaranteed purchase contracts for renewable energy, which creates secure conditions for investment in renewable energy projects

Build a consulting firm of expert Armenians and begin bringing more and more contracts for renewable energy to Armenia.

STEPS TO STARTING YOUR BUSINESS IN ARMENIA.

Choose your entity:

Private Entrepreneur (PE). A PE is an individual registered with the State Registry to whom a tax ID is assigned. A PE is not a company (not a separate legal entity) and his liability is not limited to the assets invested in the business. In other words, a PE's business and personal assets are not separated and he may be held personally responsible for any liabilities resulting from the business activities. On the positive side, this form of business is the easiest and cheapest to set up and maintain (no taxes on dividends, simplified accounting, etc.). It suits better for smaller businesses that are owned and operated by a single individual.

Limited Liability Company (LLC). An LLC is the most common corporate form in Armenia. As the name suggests, it offers limited liability to its shareholders who are not personally liable for the company's debts. The LLC form is popular because of easy and inexpensive setup and maintenance, simple management structure, and fewer corporate formalities. The number of members (shareholders) is limited to 49. You may also create an Additional Liability Company, which is essentially the same as an LLC but is different in that the shareholders are personally liable for the debts of the company to the extent specified in the articles or organization.

Joint-Stock Company (JSC). A joint-stock company is a corporate form that suits better for medium and large businesses with several shareholders. This is a stronger entity offering better privacy to shareholders and with more options for structuring the share capital and the management of the company. In an open JSC (OJSC) shares can be transferred freely, and shareholders do not have preemptive rights to purchase the shares.

Understand your fees and set your tax structure.

To select the right form for your business you may have to consider a number of tax and non-tax factors, such as limited liability, setup and maintenance costs, privacy, number of shareholders, management structure and exit options.

Branch Office (BO). A branch office is a territorial unit (subdivision) of a foreign company in Armenia. It is not a separate legal entity but an extension of a foreign company. Branch offices operating in Armenia are required to register with the State Registry and to get a taxpayer ID number.

Subsidiary. A subsidiary is a locally registered company (LLC or JSC) that is wholly or partly owned by a foreign company. All corporate matters are regulated by Armenian law. Because of the limited liability, the subsidiary's creditors will not be able to reach the foreign shareholders.

Representative Office. A representative office is similar to a branch office with the exception that it is not allowed to engage in business activities. Its role is limited to representing the interests of the foreign company in Armenia. Representative offices operating in Armenia are required to register with the State Registry and to get a taxpayer ID number.

Permanent Establishment. A permanent establishment is primarily a tax concept. It exists where a foreign company maintains a certain level of business presence in Armenia. The choice of registering a permanent establishment is primarily motivated by tax reasons. The Tax Office registers permanent establishments and assigns taxpayer ID numbers to them.

Registration Process

Company formation and corporate amendments are registered with the State Registry of Legal Entities of the Armenian Ministry of Justice. You do not have to personally appear before the Registry as lawyers can complete the formalities (file the registration documents) with a power of attorney. Typically company registration is followed by ordering a corporate rubber stamp and filing statements with the tax office.

Timeline. Remote registration can take as little as one business day if fast-track service fees are paid or three business days if no such fee is paid. Certain registrations related to branch offices and non-profits can take longer.

Documents. Document requirements may vary from case to case but, in general, individual shareholders and directors are required to provide original or legalized copies (i.e. Apostille or consular legalization) of their passports. Corporate shareholders and directors are required to provide legalized copies of their corporate documents - certificate of registration and articles of incorporation or equivalent documents. Originals or legalized copies are necessary in order to have them translated into the Armenian language and notarized.

Cost. Incorporation costs consist of government fees, legal fees, and other expenses, such as fees for translation, corporate stamps, mailing, etc.

Bank Account

As of 2020, there are seventeen banks in Armenia offering banking services to individual and corporate clients, both resident and non-resident. All the banks are privately owned and regulated by the Central Bank.

Take $9,000 US Dollars to Armenia and deposit it into your company bank account :)

9 Reasons for a Company in Armenia

1. Ultra-Fast and Easy Registration

Company registration can be done in a single day if you are physically present in Armenia and choose to use sample registration documents. If the documents are customized or in case of remote registration (with a power of attorney) the process takes one to three business days. Setting up a corporate bank account normally takes one day. Only minimum documents are required, such as the passports of the shareholders and directors. You will get a registration certificate with a taxpayer ID number, ready to start operating immediately.

2. Low Cost of Registration and Maintenance

There are no minimum capital requirements. The company's paid-up capital can be as low as $1. There are no government fees for registering or renewing the registration of a company. The company can be in good standing without paying recurring fees of filing reports. Inactive (dormant) companies do not pay taxes and do not file tax returns. There are no requirements to rent an office, hire local people (directors, officers, secretaries, accountants, etc.), open a bank account, etc.

3. No Restrictions on Foreign Ownership

Foreigners can own 100% of an Armenian company. No local partners or agents are required. No restrictions apply to the citizenship or residency of the shareholders. All the directors and employees of an Armenian company can be foreigners. They are not required to reside in Armenia or have a local address. A foreigner can be the only director and the 100% owner of a company.

4. Residence and Path to Citizenship

Owning or managing an operational company in Armenia can qualify you and your family members for a residence status (temporary, permanent, or special). Foreign business owners and investors can directly petition the Prime Minister for citizenship by exception. Under general naturalization rules, a foreigner may become eligible for Armenian citizenship after three years of residency.

5. Low Taxes

Zero-tax status is available to micro-businesses, IT start-ups, companies operating in free economic zones, industrial zones, certain border towns and villages. Other small businesses with annual sales of less than $240,000 are subject to sales (turnover) tax of only 1.5-5%. Dividends are generally taxed at 5% but this rate can be lower due to multiple double-tax treaties Armenia has signed. Armenia generally does not tax capital gains on the sale of securities, real estate, or other assets. Insurance and pension payments are also exempt from taxes. There are no taxes on gifts, inheritance, net worth, etc.

6. Privacy and Reputation

It is possible to ensure the privacy of company ownership by selecting the right corporate structure or by using nominee services. Bank secrecy is strictly protected by law and it is a crime to disclose it. As of 2020, Armenia does not participate in CRS automatic exchange of information (AEOI). Armenia does not appear on any list of offshore jurisdictions, lending to its positive image and credibility. The country has an up to date anti-money laundering legislation, and the Central Bank has ensured the safety, stability, and good reputation of the banking system.

7. Educated and Low-Cost Labor

It is possible to find a highly educated and skilled workforce in Armenia. The adult literacy rate is 99.7%. Universities in Russian, English, and French operate in Yerevan. The minimum monthly salary for full-time employment is $140, while the average monthly salary in the country is around $380. (WE MUST INCREASE THIS)

8. Economic Growth and Integration; Diaspora

In 2019, Armenia's GDP grew by 7.6% - the highest rate in all of Europe. Armenia is a member of the Eurasian Economic Union (EEU), a Russia-led economic block, with a single market of 180 million people. Armenia is also a member of the WTO, has free-trade agreements with ex-Soviet (CIS) countries, and benefits from preferential status (GSP) with the EU, Canada, Japan, Norway, and Switzerland. Armenia benefits from the human and financial resources of the Armenian diaspora - Armenian communities around the world numbering an estimated 7 million people

9. Investment-Friendly Environment

Armenia guarantees free repatriation of invested capital and profit. Foreigners are allowed to own land. Investment projects are encouraged with tax benefits and government assistance programs. Armenia has a wide network of agreements on double taxation and protection of foreign investment.

If you’d like to get started by building a business in Armenia, feel free to message me directly!

RESOURCES:

Other ways to help include:

Donate toward economic development projects: One Armenia

Volunteer work/internships/co-ops: Birthright Armenia, Armenian Volunteer Corps, Teach for Armenia, TUMO

Repatriation: Repat Armenia

Do all your Amazon shopping using www.smile.amazon.com. For zero cost you, money gets donated to whichever Armenian organization you choose, such as Birthright Armenia, Children of Armenia Fund etc.

Buy Armenian products of course: Wine, beer, jams, honey, fruits, crafts (like HDIF), etc.

Resources for those interested in doing something in Armenia:

Impact Hub. If you have a business idea or are a social entrepreneur, they can help you get your project up and running in Armenia with financial and logistical assistance.

Repat Armenia will help you with a lot of questions on investing and business or refer you to good places, even if you're not looking to repatriate.